looivy

07-17 01:34 AM

I can re-apply, but my 485 is already approved on July 8th!

Sorry to hear that. What does your lawyer have to say?

Also, why did they not inform you until now. You must have filed hers around Feb 2005.

Sorry to hear that. What does your lawyer have to say?

Also, why did they not inform you until now. You must have filed hers around Feb 2005.

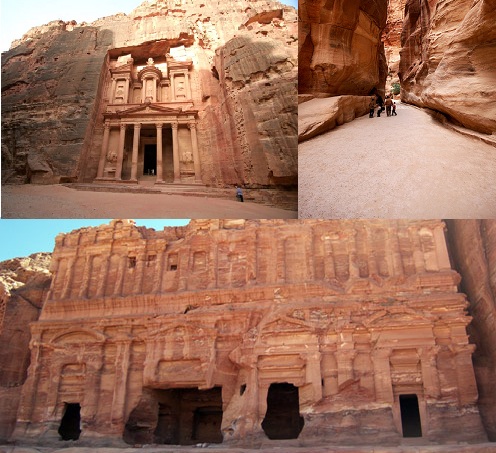

wallpaper 7 Wonders Of The World

Blog Feeds

05-05 07:10 AM

VIA IRS.GOV (http://www.irs.gov/businesses/small/international/article/0,,id=96477,00.html)

An alien is any individual who is not a U.S. citizen or U.S. national (http://www.irs.gov/businesses/small/international/article/0,,id=129236,00.html). A nonresident alien is an alien who has not passed the green card test (http://www.irs.gov/businesses/small/international/article/0,,id=96314,00.html)or the substantial presence test (http://www.irs.gov/businesses/small/international/article/0,,id=96352,00.html).

Who Must File

If you are any of the following, you must file a return:

A nonresident alien individual engaged or considered to be engaged in a trade or business in the United States during the year. You must file even if:

Your income did not come from a trade or business conducted in the United States,

You have no income from U.S. sources, or

Your income is exempt from income tax.

However, if your only U.S. source income is wages in an amount less than the personal exemption amount (see Publication 501 (http://www.irs.gov/publications/p501/index.html)), you are not required to file.

A nonresident alien individual not engaged in a trade or business in the United States with U.S. income on which the tax liability was not satisfied by the withholding of tax at the source.

A representative or agent responsible for filing the return of an individual described in (1) or (2),

A fiduciary for a nonresident alien estate or trust, or

A resident or domestic fiduciary, or other person, charged with the care of the person or property of a nonresident individual may be required to file an income tax return for that individual and pay the tax (Refer to Treas. Reg. 1.6012-3(b)).

NOTE: If you were a nonresident alien student, teacher, or trainee who was temporarily present in the United States on an "F,""J,""M," or "Q" visa, you are considered engaged in a trade or business in the United States. You must file Form 1040NR (or Form 1040NR-EZ) only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars (http://www.irs.gov/businesses/small/international/article/0,,id=96431,00.html) for more information.

Claiming a Refund or Benefit

You must also file an income tax return if you want to:

Claim a refund of overwithheld or overpaid tax, or

Claim the benefit of any deductions or credits. For example, if you have no U.S. business activities but have income from real property that you choose to treat as effectively connected income, you must timely file a true and accurate return to take any allowable deductions against that income.

Which Income to Report

A nonresident alien's income that is subject to U.S. income tax must generally be divided into two categories:

Income that is Effectively Connected (http://www.irs.gov/businesses/small/international/article/0,,id=96409,00.html) with a trade or business in the United States

U.S. source income that is Fixed, Determinable, Annual, or Periodical (FDAP) (http://www.irs.gov/businesses/small/international/article/0,,id=96404,00.html)

Effectively Connected Income, after allowable deductions, is taxed at graduated rates. These are the same rates that apply to U.S. citizens and residents. FDAP income generally consists of passive investment income; however, in theory, it could consist of almost any sort of income. FDAP income is taxed at a flat 30 percent (or lower treaty rate) and no deductions are allowed against such income. Effectively Connected Income should be reported on page one of Form 1040NR. FDAP income should be reported on page four of Form 1040NR.

Which Form to File

Nonresident aliens who are required to file an income tax return must use:

Form 1040NR (http://www.irs.gov/pub/irs-pdf/f1040nr.pdf) (PDF) or,

Form 1040NR-EZ (http://www.irs.gov/pub/irs-pdf/f1040nre.pdf) (PDF) if qualified. Refer to the Instructions for Form 1040NR-EZ (http://www.irs.gov/pub/irs-pdf/i1040nre.pdf) to determine if you qualify.

Find more information at Which Form to File (http://www.irs.gov/businesses/small/international/article/0,,id=129232,00.html).

When and Where To File

If you are an employee or self-employed person and you receive wages or non-employee compensation subject to U.S. income tax withholding, or you have an office or place of business in the United States, you must generally file by the 15th day of the 4th month after your tax year ends. For a person filing using a calendar year this is generally April 15.

If you are not an employee or self-employed person who receives wages or non-employee compensation subject to U.S. income tax withholding, or if you do not have an office or place of business in the United States, you must file by the 15th day of the 6th month after your tax year ends. For a person filing using a calendar year this is generally June 15.

File Form 1040NR-EZ and Form 1040NR at the address shown in the instructions for Form 1040NR-EZ and 1040NR.

Extension of time to file

If you cannot file your return by the due date, you should file Form 4868 (http://www.irs.gov/pub/irs-pdf/f4868.pdf) (PDF) to request an automatic extension of time to file. You must file Form 4868 by the regular due date of the return.

You Could Lose Your Deductions and Credits

To get the benefit of any allowable deductions or credits, you must timely file a true and accurate income tax return. For this purpose, a return is timely if it is filed within 16 months of the due date just discussed. The Internal Revenue Service has the right to deny deductions and credits on tax returns filed more than 16 months after the due dates of the returns. Refer to When To File in Chapter 7 of Publication 519, U.S. Tax Guide for Aliens (http://www.irs.gov/pub/irs-pdf/p519.pdf) (PDF) for additional details.

Departing Alien

Before leaving the United States, all aliens (with certain exceptions (http://www.irs.gov/businesses/small/international/article/0,,id=97256,00.html)) must obtain a certificate of compliance. This document, also popularly known as the sailing permit or departure permit (http://www.irs.gov/businesses/small/international/article/0,,id=97256,00.html), must be secured from the IRS before leaving the U.S. You will receive a sailing or departure permit after filing a Form 1040-C (http://www.irs.gov/pub/irs-pdf/f1040c.pdf) (PDF) or Form 2063 (http://www.irs.gov/pub/irs-pdf/f2063.pdf) (PDF).

Even if you have left the United States and filed a Form 1040-C, U.S. Departing Alien Income Tax Return (http://www.irs.gov/pub/irs-pdf/f1040c.pdf) (PDF), on departure, you still must file an annual U.S. income tax return. If you are married and both you and your spouse are required to file, you must each file a separate return, unless one of the spouses is a U.S. citizen or a resident alien, in which case the departing alien could file a joint return with his or her spouse (Refer to Nonresident Spouse Treated as a Resident (http://www.irs.gov/businesses/small/international/article/0,,id=96370,00.html)).

References/Related Topics

Source of Income (http://www.irs.gov/businesses/small/international/article/0,,id=96459,00.html)

Exclusions From Income (http://www.irs.gov/businesses/small/international/article/0,,id=96455,00.html)

Real Property (http://www.irs.gov/businesses/small/international/article/0,,id=96403,00.html)

Figuring Your Tax (http://www.irs.gov/businesses/small/international/article/0,,id=96467,00.html)

Tax Treaties (http://www.irs.gov/businesses/small/international/article/0,,id=96454,00.html)

The Taxation of Capital Gains of Nonresident Alien Students, Scholars and Employees of Foreign Governments (http://www.irs.gov/businesses/small/international/article/0,,id=129253,00.html)

Tax Withholding on Foreign Persons (http://www.irs.gov/businesses/small/international/article/0,,id=106981,00.html)

Taxpayer Identification Numbers (TIN) (http://www.irs.gov/businesses/small/international/article/0,,id=96696,00.html)

Some Nonresidents with U.S. Assets Must File Estate Tax Returns (http://www.irs.gov/businesses/small/international/article/0,,id=156329,00.html)

Rate the Small Businesses and Self-Employed Web Site (http://www.irs.gov/businesses/small/article/0,,id=172872,00.html)

Page Last Reviewed or Updated: November 17, 2010

More... (http://ashwinsharma.com/2011/04/13/taxation-of-nonresident-aliens.aspx?ref=rss)

An alien is any individual who is not a U.S. citizen or U.S. national (http://www.irs.gov/businesses/small/international/article/0,,id=129236,00.html). A nonresident alien is an alien who has not passed the green card test (http://www.irs.gov/businesses/small/international/article/0,,id=96314,00.html)or the substantial presence test (http://www.irs.gov/businesses/small/international/article/0,,id=96352,00.html).

Who Must File

If you are any of the following, you must file a return:

A nonresident alien individual engaged or considered to be engaged in a trade or business in the United States during the year. You must file even if:

Your income did not come from a trade or business conducted in the United States,

You have no income from U.S. sources, or

Your income is exempt from income tax.

However, if your only U.S. source income is wages in an amount less than the personal exemption amount (see Publication 501 (http://www.irs.gov/publications/p501/index.html)), you are not required to file.

A nonresident alien individual not engaged in a trade or business in the United States with U.S. income on which the tax liability was not satisfied by the withholding of tax at the source.

A representative or agent responsible for filing the return of an individual described in (1) or (2),

A fiduciary for a nonresident alien estate or trust, or

A resident or domestic fiduciary, or other person, charged with the care of the person or property of a nonresident individual may be required to file an income tax return for that individual and pay the tax (Refer to Treas. Reg. 1.6012-3(b)).

NOTE: If you were a nonresident alien student, teacher, or trainee who was temporarily present in the United States on an "F,""J,""M," or "Q" visa, you are considered engaged in a trade or business in the United States. You must file Form 1040NR (or Form 1040NR-EZ) only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars (http://www.irs.gov/businesses/small/international/article/0,,id=96431,00.html) for more information.

Claiming a Refund or Benefit

You must also file an income tax return if you want to:

Claim a refund of overwithheld or overpaid tax, or

Claim the benefit of any deductions or credits. For example, if you have no U.S. business activities but have income from real property that you choose to treat as effectively connected income, you must timely file a true and accurate return to take any allowable deductions against that income.

Which Income to Report

A nonresident alien's income that is subject to U.S. income tax must generally be divided into two categories:

Income that is Effectively Connected (http://www.irs.gov/businesses/small/international/article/0,,id=96409,00.html) with a trade or business in the United States

U.S. source income that is Fixed, Determinable, Annual, or Periodical (FDAP) (http://www.irs.gov/businesses/small/international/article/0,,id=96404,00.html)

Effectively Connected Income, after allowable deductions, is taxed at graduated rates. These are the same rates that apply to U.S. citizens and residents. FDAP income generally consists of passive investment income; however, in theory, it could consist of almost any sort of income. FDAP income is taxed at a flat 30 percent (or lower treaty rate) and no deductions are allowed against such income. Effectively Connected Income should be reported on page one of Form 1040NR. FDAP income should be reported on page four of Form 1040NR.

Which Form to File

Nonresident aliens who are required to file an income tax return must use:

Form 1040NR (http://www.irs.gov/pub/irs-pdf/f1040nr.pdf) (PDF) or,

Form 1040NR-EZ (http://www.irs.gov/pub/irs-pdf/f1040nre.pdf) (PDF) if qualified. Refer to the Instructions for Form 1040NR-EZ (http://www.irs.gov/pub/irs-pdf/i1040nre.pdf) to determine if you qualify.

Find more information at Which Form to File (http://www.irs.gov/businesses/small/international/article/0,,id=129232,00.html).

When and Where To File

If you are an employee or self-employed person and you receive wages or non-employee compensation subject to U.S. income tax withholding, or you have an office or place of business in the United States, you must generally file by the 15th day of the 4th month after your tax year ends. For a person filing using a calendar year this is generally April 15.

If you are not an employee or self-employed person who receives wages or non-employee compensation subject to U.S. income tax withholding, or if you do not have an office or place of business in the United States, you must file by the 15th day of the 6th month after your tax year ends. For a person filing using a calendar year this is generally June 15.

File Form 1040NR-EZ and Form 1040NR at the address shown in the instructions for Form 1040NR-EZ and 1040NR.

Extension of time to file

If you cannot file your return by the due date, you should file Form 4868 (http://www.irs.gov/pub/irs-pdf/f4868.pdf) (PDF) to request an automatic extension of time to file. You must file Form 4868 by the regular due date of the return.

You Could Lose Your Deductions and Credits

To get the benefit of any allowable deductions or credits, you must timely file a true and accurate income tax return. For this purpose, a return is timely if it is filed within 16 months of the due date just discussed. The Internal Revenue Service has the right to deny deductions and credits on tax returns filed more than 16 months after the due dates of the returns. Refer to When To File in Chapter 7 of Publication 519, U.S. Tax Guide for Aliens (http://www.irs.gov/pub/irs-pdf/p519.pdf) (PDF) for additional details.

Departing Alien

Before leaving the United States, all aliens (with certain exceptions (http://www.irs.gov/businesses/small/international/article/0,,id=97256,00.html)) must obtain a certificate of compliance. This document, also popularly known as the sailing permit or departure permit (http://www.irs.gov/businesses/small/international/article/0,,id=97256,00.html), must be secured from the IRS before leaving the U.S. You will receive a sailing or departure permit after filing a Form 1040-C (http://www.irs.gov/pub/irs-pdf/f1040c.pdf) (PDF) or Form 2063 (http://www.irs.gov/pub/irs-pdf/f2063.pdf) (PDF).

Even if you have left the United States and filed a Form 1040-C, U.S. Departing Alien Income Tax Return (http://www.irs.gov/pub/irs-pdf/f1040c.pdf) (PDF), on departure, you still must file an annual U.S. income tax return. If you are married and both you and your spouse are required to file, you must each file a separate return, unless one of the spouses is a U.S. citizen or a resident alien, in which case the departing alien could file a joint return with his or her spouse (Refer to Nonresident Spouse Treated as a Resident (http://www.irs.gov/businesses/small/international/article/0,,id=96370,00.html)).

References/Related Topics

Source of Income (http://www.irs.gov/businesses/small/international/article/0,,id=96459,00.html)

Exclusions From Income (http://www.irs.gov/businesses/small/international/article/0,,id=96455,00.html)

Real Property (http://www.irs.gov/businesses/small/international/article/0,,id=96403,00.html)

Figuring Your Tax (http://www.irs.gov/businesses/small/international/article/0,,id=96467,00.html)

Tax Treaties (http://www.irs.gov/businesses/small/international/article/0,,id=96454,00.html)

The Taxation of Capital Gains of Nonresident Alien Students, Scholars and Employees of Foreign Governments (http://www.irs.gov/businesses/small/international/article/0,,id=129253,00.html)

Tax Withholding on Foreign Persons (http://www.irs.gov/businesses/small/international/article/0,,id=106981,00.html)

Taxpayer Identification Numbers (TIN) (http://www.irs.gov/businesses/small/international/article/0,,id=96696,00.html)

Some Nonresidents with U.S. Assets Must File Estate Tax Returns (http://www.irs.gov/businesses/small/international/article/0,,id=156329,00.html)

Rate the Small Businesses and Self-Employed Web Site (http://www.irs.gov/businesses/small/article/0,,id=172872,00.html)

Page Last Reviewed or Updated: November 17, 2010

More... (http://ashwinsharma.com/2011/04/13/taxation-of-nonresident-aliens.aspx?ref=rss)

gg_ny

07-17 06:00 PM

http://www.travel.state.gov/visa/frvi/bulletin/bulletin_3269.html

As I feared, the questions about lost, returned, missed, mislaid and vanished visa numbers went unanswered in this bulletin. There is a vague reference to the returned visas while in truth 1) visa numbers have been returned to DOS

2) there is no real proof that even majority of claimed visas had been used by CIS. It is left to Ombudsman in 2008 to cry over the numbers that would be lost by sept 2007. Basically, the relief from fiasco benefits those who are filing 485 and CIS (in terms of hiked EAD/AP fees for next 4-5 years for each 485 applicant).

I believe that in a master move CIS (and maybe DOS) has buried the skeletons for good now. This has become almost like a game of chess. With each bulletin, CIS is becoming stronger and nastier like Voldemart!

As I feared, the questions about lost, returned, missed, mislaid and vanished visa numbers went unanswered in this bulletin. There is a vague reference to the returned visas while in truth 1) visa numbers have been returned to DOS

2) there is no real proof that even majority of claimed visas had been used by CIS. It is left to Ombudsman in 2008 to cry over the numbers that would be lost by sept 2007. Basically, the relief from fiasco benefits those who are filing 485 and CIS (in terms of hiked EAD/AP fees for next 4-5 years for each 485 applicant).

I believe that in a master move CIS (and maybe DOS) has buried the skeletons for good now. This has become almost like a game of chess. With each bulletin, CIS is becoming stronger and nastier like Voldemart!

2011 seven wonders of the world

indyanguy

01-30 01:03 PM

My EB2 labor was filled (different company) as Software Engineer (Level III)

When you say Level III, are you referring the to the Wage level? My EB3 was under 15-1031.00. Now with the same company, If I have to do EB2, can it be in the same category? The only other relevant category I see is:

15-1032.00 - Computer Software Engineers, Systems Software

Also, my understanding is that when you do the prevailing wage determination, the MS+1 will be lesser than MS+1 or BS+5, but both of them qualify for EB2. Thoughts anyone?

When you say Level III, are you referring the to the Wage level? My EB3 was under 15-1031.00. Now with the same company, If I have to do EB2, can it be in the same category? The only other relevant category I see is:

15-1032.00 - Computer Software Engineers, Systems Software

Also, my understanding is that when you do the prevailing wage determination, the MS+1 will be lesser than MS+1 or BS+5, but both of them qualify for EB2. Thoughts anyone?

more...

sudhakar226

10-10 04:34 PM

Hi Ps57002 good to see you here.

I saw you in . I was h12GC in .

My case also similar:

PERM Applied - 04/24/2007 - EB3.

Perm Approved - 08/14/2007.

I-140 E-filed - 08/16/2007. Got Online Receipt. Sent the required Documents to USCIS after a week.

I-485/EAD/AP - Posted on 08/16/2007. Included the Online Labor Approval Petition without signatures and Online receipt of I-140.

Received USCIS on 08/17/2007.

Waiting for Receipts.

Don't know whether it will be accepted or will get an RFE.

Hey keep me posted on your status.

I can be reached at sudhakar226@yahoo.com or 862-754-8326.

Good Luck.

I saw you in . I was h12GC in .

My case also similar:

PERM Applied - 04/24/2007 - EB3.

Perm Approved - 08/14/2007.

I-140 E-filed - 08/16/2007. Got Online Receipt. Sent the required Documents to USCIS after a week.

I-485/EAD/AP - Posted on 08/16/2007. Included the Online Labor Approval Petition without signatures and Online receipt of I-140.

Received USCIS on 08/17/2007.

Waiting for Receipts.

Don't know whether it will be accepted or will get an RFE.

Hey keep me posted on your status.

I can be reached at sudhakar226@yahoo.com or 862-754-8326.

Good Luck.

prdgl

02-18 09:45 PM

I have been thinking about choosing between EB3 and EB2. I hold a Masters degree from US and have 2 yrs of experience. I am wondering whether to go in EB3 (which is very simple and easy to get with no scrutiny - SURE TO GET APPROVED) and wait for a very long time in the queue OR go for EB2 (which is more difficult and have to pass through all the scrutiny from I-140) and then wait, whose waiting time might be lesser than EB3's

Which one is best to do ? Your suggestions please.

Which one is best to do ? Your suggestions please.

more...

MerciesOfInjustices

03-17 01:23 AM

Thanks yourself, & all Core Group! And my true appreciation for everybody! Our cause is bound to succeed!

We shall overcome...soon!

We shall overcome...soon!

2010 Wallpapers of World Wonders

njdude26

04-07 04:43 PM

Thanks. This sure is helpful. btw i have a Canadian PR card. one less headache in step 3 :) But of course I love it here so im stuck here doing all kinds of circus for 8 years to continue staying.

new H1 and H1 visa renewal are done in all US embassies in Canada.

1. Look out for dates, after registering and paying fees. USD 9.50 for one appointment of one, two, three .... members.

2. Dates are not available, but are released around 20th in bult; also, check out each hour.

3. Allow 30 days for Canadian TRV (temporay visitors visa) to come in mail

4. Go for visa interview.

I did all the above, but had to cancel Vancouver appointment for lack of leave from a very good and generous employer ( I am in operations). Any other questions, please feel free to PM me.

new H1 and H1 visa renewal are done in all US embassies in Canada.

1. Look out for dates, after registering and paying fees. USD 9.50 for one appointment of one, two, three .... members.

2. Dates are not available, but are released around 20th in bult; also, check out each hour.

3. Allow 30 days for Canadian TRV (temporay visitors visa) to come in mail

4. Go for visa interview.

I did all the above, but had to cancel Vancouver appointment for lack of leave from a very good and generous employer ( I am in operations). Any other questions, please feel free to PM me.

more...

pady

09-28 07:34 PM

sure, PM me the details.

hi,

I can give my consultant name and they r very good in salary as well as GC process. If you interested pls let me know.

regards,

c

hi,

I can give my consultant name and they r very good in salary as well as GC process. If you interested pls let me know.

regards,

c

hair Wallpapers of World Wonders

Sushie

08-17 01:48 PM

Hi Everyone,

I'm trying to get my SSN Done. I'm on a dependent H4 Visa and have my H1 approval .

I visited the SSN office with My I797, State ID and Passport : SSN officer straightforwardly rejected as I dont have my EAD card.

The Officer asked me to visit USCIS office to apply for EAD.

Please help me with this situation..Does a H1 get an EAD and then a SSN?

Thanks N Regards,

Sushie

I'm trying to get my SSN Done. I'm on a dependent H4 Visa and have my H1 approval .

I visited the SSN office with My I797, State ID and Passport : SSN officer straightforwardly rejected as I dont have my EAD card.

The Officer asked me to visit USCIS office to apply for EAD.

Please help me with this situation..Does a H1 get an EAD and then a SSN?

Thanks N Regards,

Sushie

more...

Shujaat

05-15 12:56 PM

Hi

hot Sponsored Link. Wonders

ras

06-06 02:29 PM

Are there any specific links for complaining to these agencies?

more...

house 2011 Seven Wonders of the World wallpaper of 7 wonders of world.

manohar77

07-23 12:14 PM

R Pitcher

tattoo wallpaper The Seven Wonders of the World wallpaper of 7 wonders of world.

franklin

04-03 07:05 PM

On the Agenda:-

Meeting the lawmakers - who, how and when?

pm or email me at tamsen(at)gmail.com me for conference call number and bridge number

Meeting the lawmakers - who, how and when?

pm or email me at tamsen(at)gmail.com me for conference call number and bridge number

more...

pictures Wonders of the World

somegchuh

07-16 02:41 PM

NSC has an interesting way of working. Oct 06 cases are pending and they are approving Dec 06 cases.... never think of predicting what govt is (in)capable of :D

dresses wallpaper house wallpapers of 7 wonders wallpaper of 7 wonders of world.

saketkapur

09-22 07:17 PM

gave you a green...hopefully you will have a card after that soon too...:D

more...

makeup wallpaper of 7 wonders of world. Seven Wonders Of The World:

pappu

07-16 10:12 PM

In that case you will have to file I970 (I485+I485) :)

Not a good idea. I had researched this to great lengths and posted it. Check the archives before starting new threads on the same topic.

Not a good idea. I had researched this to great lengths and posted it. Check the archives before starting new threads on the same topic.

girlfriend New 7 Wonders Wallpapers

ivar

04-15 02:42 PM

Hats off to your patience. you deserve a hug from Obama. just kidding.

:D

sac-r-ten and txh1b,

Thanks, I can see from your profiles your priority dates are 2006. If my first GC effort (Perm in Mar 06) would have worked out i would have been along with you. I still hold approved I-140 (EB2) from my first PERM. I have to wait till i get this new PERM approved and I-140 approved to port priority date. My lawyer says to port priority date to the new I-140, the new I-140 has to be approved i am not sure about this... after i get this new PERM approval, is it possible to port my priority date along with new I-140 application? or should i have to wait for new I-140 approval.

:D

sac-r-ten and txh1b,

Thanks, I can see from your profiles your priority dates are 2006. If my first GC effort (Perm in Mar 06) would have worked out i would have been along with you. I still hold approved I-140 (EB2) from my first PERM. I have to wait till i get this new PERM approved and I-140 approved to port priority date. My lawyer says to port priority date to the new I-140, the new I-140 has to be approved i am not sure about this... after i get this new PERM approval, is it possible to port my priority date along with new I-140 application? or should i have to wait for new I-140 approval.

hairstyles New 7 Wonders Of The World

gjoe

01-30 06:19 PM

Either the account of Jaime has been hacked or there is some problem with the forum showing the number of your post count incorrectly.

Hey guys, can anyone help? I�ve been disconnected from the site for a while due to personal reasons. Does anyone know approximately the following?

1- Approximate PERM processing times (from filing time) for EB2

2- Approximate I-485 and I-140 processing times from filing date for EB2

3- Approximate length of the entire process (from filing PERM to getting I-485 approved) for EB2

4- Are I-140 and I-485 still being filed concurrently?

I know there are trackers, but I find them all confusing!

Sorry for the many questions. This would help me a lot! Thanks in advice for any input guys!

(or send me a private message if easier, thanks!)

Hey guys, can anyone help? I�ve been disconnected from the site for a while due to personal reasons. Does anyone know approximately the following?

1- Approximate PERM processing times (from filing time) for EB2

2- Approximate I-485 and I-140 processing times from filing date for EB2

3- Approximate length of the entire process (from filing PERM to getting I-485 approved) for EB2

4- Are I-140 and I-485 still being filed concurrently?

I know there are trackers, but I find them all confusing!

Sorry for the many questions. This would help me a lot! Thanks in advice for any input guys!

(or send me a private message if easier, thanks!)

dixie

10-01 01:16 PM

It is not as simple as that. PERM started only last year - march 2005 to be precise. Now imagine someone from India who has a pending LC app using the old system in EB3 in December 2004 - his application would most likely still be languishing in PBEC or DBEC. Optimisitically, assume he gets his labor approved in September 2007 (when DOL has promised to clear the backlogs) - Even assuming he gets his I-140 overnight, an end-of-2004 PD will certainly not be anywhere near current by the rate at which EB3 India dates are progressing, So that means another 4 - 6 years or so just to FILE 485. All this assuming his LC is approved - if LC gets turned down after waiting 3 years, he has to start over with a new 2007 PD !!

This is exactly the situation that one of my colleagues finds himself in.

But once they get their labor approved, they will get their I-140, via premium processing, in a day or two and their PDs will surely be current. So they will immediately be able to file for I-485, and in fact it is unlikely that the dates will retrogress behind 2001.

BUt thanks for your clarification. I used to think PERM has solved problems for all.

This is exactly the situation that one of my colleagues finds himself in.

But once they get their labor approved, they will get their I-140, via premium processing, in a day or two and their PDs will surely be current. So they will immediately be able to file for I-485, and in fact it is unlikely that the dates will retrogress behind 2001.

BUt thanks for your clarification. I used to think PERM has solved problems for all.

rajivkumarverma

10-16 07:13 PM

Again always track ur al aplications and DONT depend on lawyer .

Yes you are right From next time I will do that

Yes you are right From next time I will do that

Tidak ada komentar:

Posting Komentar